You’ve meticulously planned your publishing budget, only to watch it vanish the moment your shipment hits the port. I’ll show you why a “cheap” quote is often a financial trap—and how to use the Total Cost of Ownership (TCO) model to protect your project’s net profit in the complex 2026 trade landscape.

The true cost of China book printing is calculated using the Total Cost of Ownership (TCO) formula, which includes unit price, duties (Section 301), logistics, and a “rework multiplier.” Low unit prices often mask hidden fees such as port demurrage ($150-$300/day) and compliance rework, typically adding 20% or more to the initial quote. Choosing Delivered Duty Paid (DDP) terms acts as a financial hedge by locking in these variable costs.

If you want to move beyond the “unit price illusion” and see the exact formula we use to secure project margins, keep reading. We’ve combined 10 years of factory-floor experience with real-world data to help you navigate the AI-driven customs era of 2026.

Why Your Budget is Leaking

Imagine this: You found a supplier for your China book printing project with low unit prices that seemingly guaranteed a 40% margin. On paper, it was a win.

But as your books reach the Port of Long Beach, the “profit killers” appear. You receive an invoice for $3,600 in unexpected port storage fees. Then, a notification arrived: your pallets don’t meet U.S. warehouse standards. Suddenly, that “cheap” quote has transformed into a variable liability, eroding your net profit by 20% or more.

In the current 2026 trade environment, the factory-gate price is just a distraction. To survive, you must look past the initial quote and calculate the Total Cost of Ownership (TCO).

The Risks of Chasing the Lowest Quote

When a quote for book printing in China looks too good to be true, the supplier is usually externalizing risks that you will eventually inherit. These “silent killers” are often buried in the fine print.

- Port Demurrage & Detention (D&D): Most U.S. ports offer only 4–5 days of free storage. After that, demurrage and detention (D&D) fees jump to $150–$300 per container/day, often doubling every five days.

- The 15x Rework Multiplier: If a labeling error is caught at our factory, fixing it costs pennies. But if it’s found in a U.S. distribution center? Manual labor costs jump to $1.50–$2.50 per book.

As Thad McIlroy, a leading publishing consultant and founder of The Future of Publishing, points out, the economics of the industry are shifting. He notes that the focus has moved from “how cheap can we print it” to “how safely can we source it.” In today’s volatile market, the financial hit from a quality-driven rework or a stock-out due to shipping delays far outweighs the pennies saved on a low-ball overseas quote.

The CFO’s Framework

To move your projects from “variable hopes” to “fixed realities,” you need a robust framework that accounts for the entire lifecycle of the asset. We help our clients apply a comprehensive book printing cost formula to every production run.

- P \times Q: The basic unit price multiplied by quantity.

- T (Tariffs & Duties): Including Section 301 tariffs and specific HTS classification costs.

- L (Landed Logistics): Ocean freight, trucking, and those dangerous port-side surcharges when shipping books from China.

- R \times M (Rework Multiplier): The contingency fund for domestic manual intervention.

- C (Compliance): Costs for third-party safety testing like CPSIA safety testing.

- O (Opportunity Cost): The lost sales revenue caused by shipping delays or stock-outs.

How to Audit a Quote in 60 Seconds

A simple way to verify a supplier’s transparency is the Landed-to-Quote (LTQ) Ratio: Total Landed Cost / Initial Ex-Factory Quote = LTQ. In high-quality production, a realistic LTQ typically falls between 1.25 and 1.45.

If a supplier presents a budget that implies an LTQ of only 1.1, they are likely hiding risks. As a financial lead, you should treat a low LTQ as a red flag for future “hidden fees.”

Navigating Trade Compliance in the AI Era

In 2026, U.S. Customs and Border Protection (CBP) has transitioned to AI-driven automated auditing. This technology scans every line of your import documentation for HTS code (Harmonized Tariff Schedule) inconsistencies.

Many brokers still suggest “creative” classification to lower duties. This is a trap. The legal responsibility rests solely on the Importer of Record (IOR)—which is you, the publisher.

William Perry, a trade lawyer and former attorney for the USITC, warns that Customs authorities can look back five years into your records. A single caught error today could lead to retroactive penalties that dwarf the original value of the goods.

Ready to Lock in Your Printing Budget?

Don’t let shipping spikes and hidden fees destroy your margins. Explore our high-quality printing solutions and get a transparent, all-in DDP quote today.

DDP as a Financial Hedging Strategy

For many procurement teams, Delivered Duty Paid (DDP) is seen as a matter of convenience. For a CFO, however, DDP is a sophisticated financial tool. By choosing DDP, you are essentially purchasing a “fixed-price option” on your logistics.

| Cost Factor | FOB (Variable Risk) | DDP (Asset Hedge) |

|---|---|---|

| Budget Nature | Variable Liability | Fixed Asset Cost |

| Market Volatility | You pay for freight spikes | Supplier absorbs all spikes |

| Customs Risk | Your team manages entry | Supplier guarantees entry |

| Financial Variance | High (Unpredictable) | Zero (Guaranteed) |

The $15,000 “Hidden Cost” Disaster

At Mainland Printing, we often see clients who come to us after a “low-cost” disaster. One publisher recently tried to save $4,000 on an 8,000-copy run of children’s books featuring plastic pull-tabs.

The agent used a standard HTS code for “books” to keep the quote low. However, the AI-driven audit flagged the plastic components as “toys,” requiring higher scrutiny. The cargo sat in the port for 12 days, accruing $3,600 in demurrage fees.

Worse, the agent used non-compliant pallets. They buckled under weight, leading to cover cracking in 5% of the books. The subsequent manual repair in a U.S. warehouse cost $2.50 per book. What started as a $4,000 “saving” ended as a $15,000 net loss.

A Practical Checklist for Financial Security

To ensure your next project doesn’t become a liability, use this 5-minute audit in your next meeting:

- Guaranteed Landed Cost: Does the quote lock in the price at your warehouse door, or are you liable for port “extras”?

- HTS Code Verification: Does the tax code account for electronics, toys, or specific bindings?

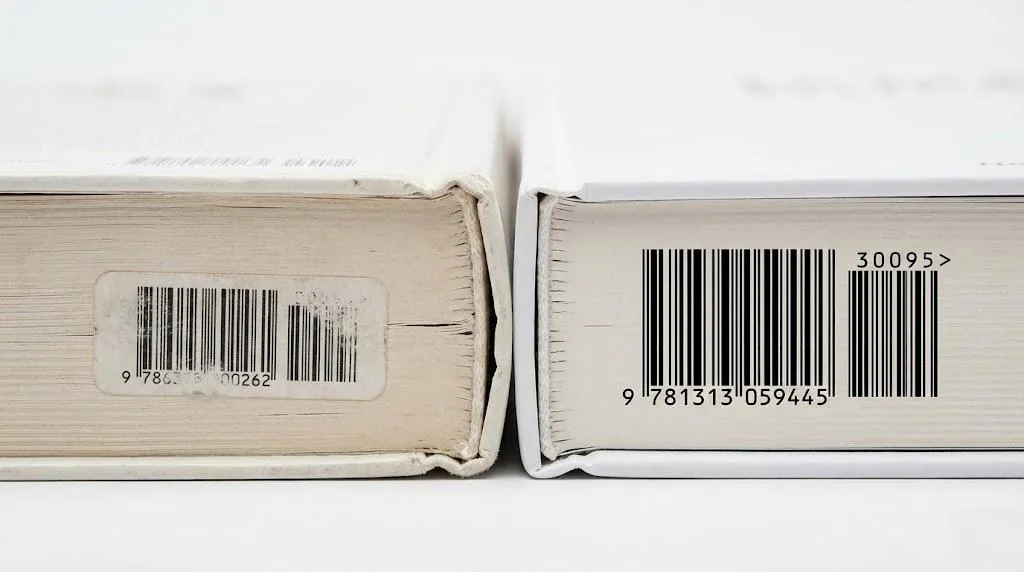

- ANSI-Compliant Labeling: Will your barcodes pass U.S. retailer contrast tests without manual re-labeling?

- Audit-Proof Documentation: Can the supplier provide an ISO-certified audit trail for all materials?

Securing Your 2026 Profitability

Securing your project’s profit means identifying hidden fees before they hit your balance sheet. By applying the TCO model and choosing a partner that understands the financial reality of 2026 trade, you move your strategy from a game of chance to a pillar of corporate stability.

Avoiding the low unit prices trap is the first step toward true financial security.

Ready to Secure Your Printing Profit?

Don’t let hidden fees erode your margins. Download our TCO guide or speak with a specialist to get a guaranteed all-in DDP quote today.